Successful turnaround of an established automotive supplier company

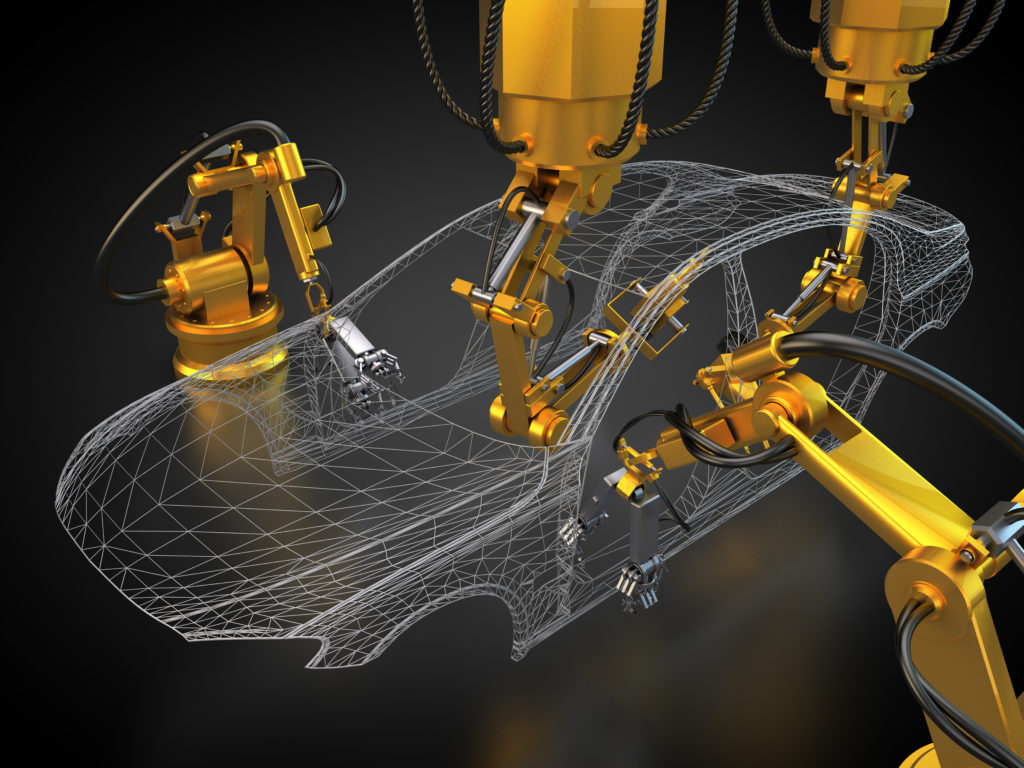

An internationally established company in the automotive supply industry was faced with the challenge of restoring its competitiveness in a difficult market environment. The use of an interim CRO and the implementation of a comprehensive restructuring and realignment project enabled significant improvements to be achieved and the company to be put back on “new feet”.

Successful turnaround of an established automotive supplier company MEHR »